My approach to wealth Generation

Why most people are wrong about getting rich

My approach to wealth generation

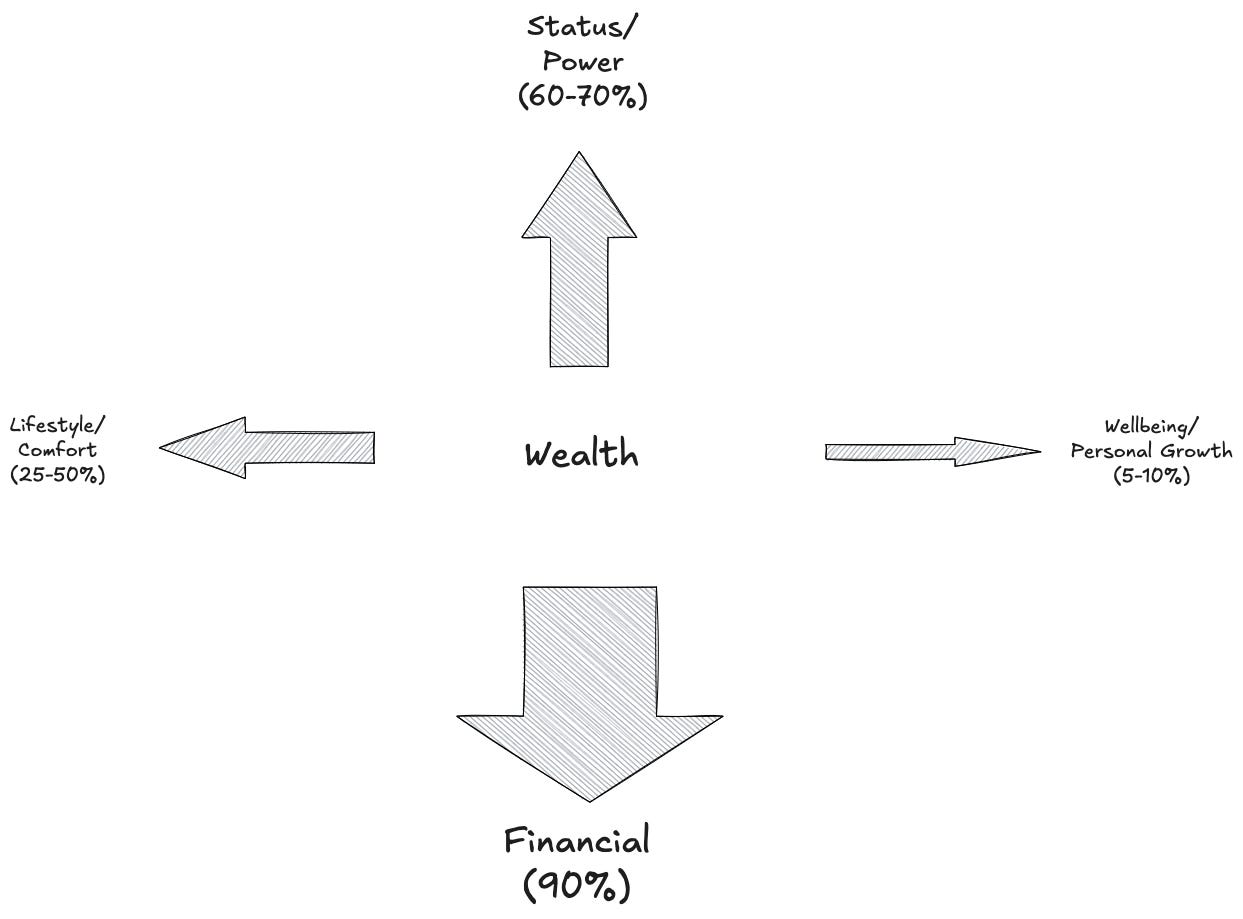

What comes to mind when you hear the word “wealth”? I bet it’s money. About 90% of people associate wealth with financial terms.

Research consistently shows that financial association dominates how people perceive wealth.

Countless books, courses, and posts reinforce this narrow view. Yet this equation has always struck me as incomplete.

Money without health.

Having money is undeniably better than not having it - better doctors, better specialists, better care. And in a pragmatic sense, professionals paid directly by you often have a stronger incentive to keep you in good shape.

So simple and pragmatic.

Money also matters when you can’t be healthy. Being able to afford an environment adapted to your needs can define your quality of life, regardless of limitations.

Still, the real win is having both money and health.

When I was a kid, I’ve read one of Ropert Kiyosaki’s books, most likely Poor Dad, Rich Dad and there was one sentence that stayed in my head for the rest of my life:

Poor people think like: “this OR that”, rich people think like: “this AND that”.

I embraced this early: if I don’t have to choose, why would I?

My mission became simple - pursue wealth without losing health, and ideally, improve it along the way.

Since then I’ve tried to find a solution to how to pawn my way to the wealth by at least not-loosing health on the way, and if possible, get healthier in the process.

Money without freedom

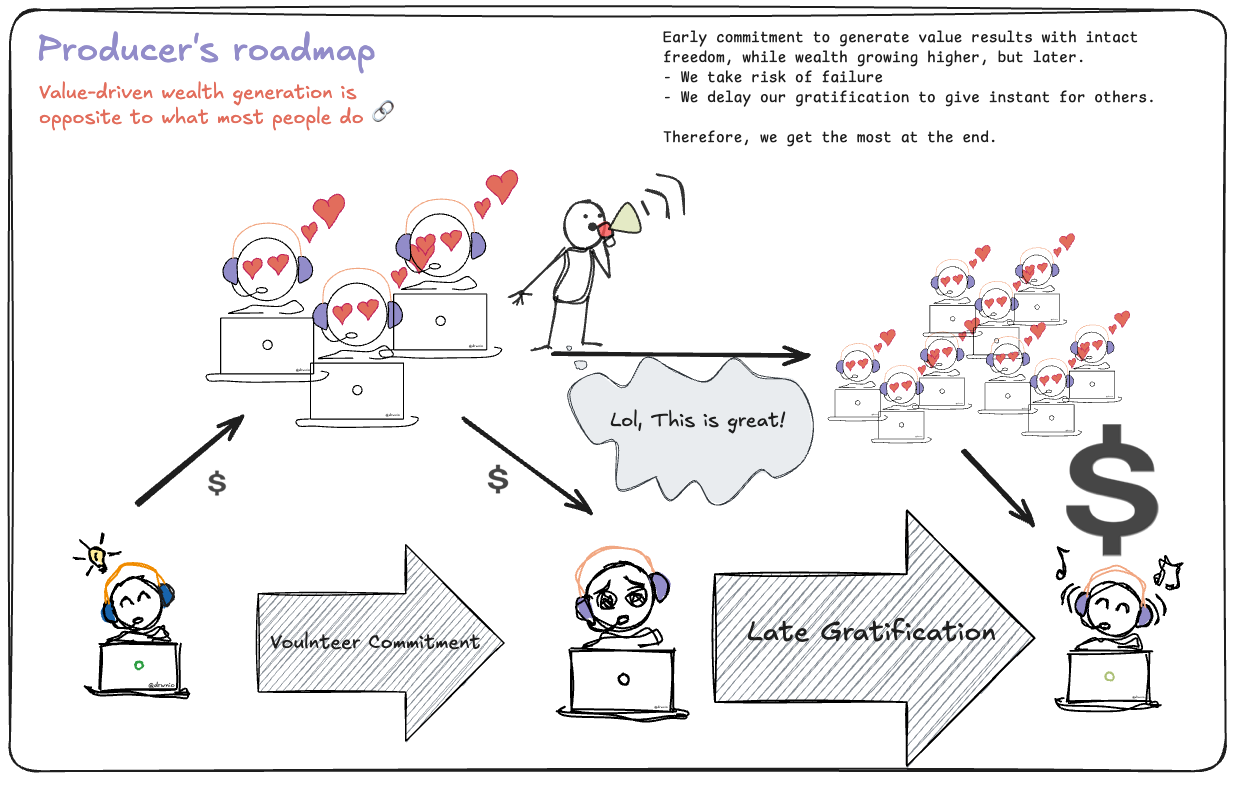

There are many ways to earn well. The one I respect most: create value, or create value at scale. It gives you income and freedom.

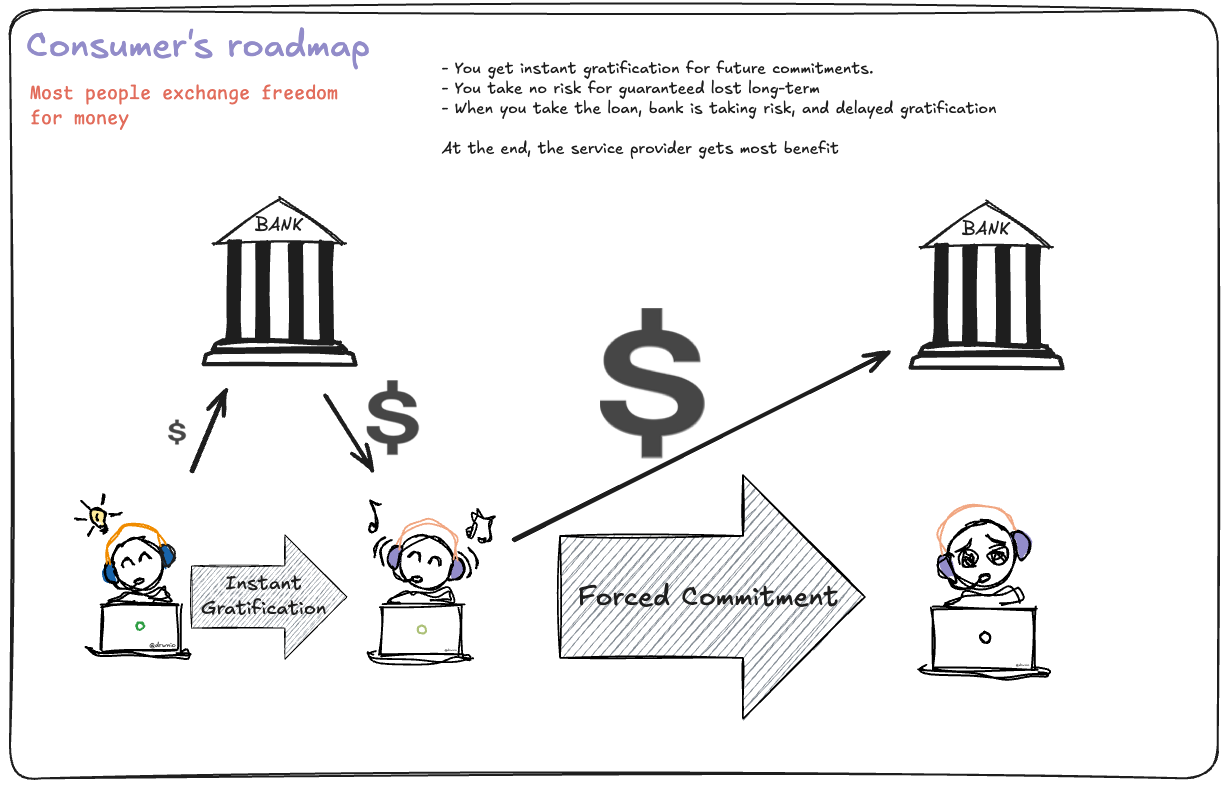

But there is other way too - you may trade your freedom in exchange of more money, and this is what most people do.

A loan is the perfect metaphor. You get the cash upfront, but the price is years of commitment.

Taking big loans, climbing corporate ladders that own your calendar, or signing your life to a high-paying but soul-crushing role - all are classic examples of the second path. You may end up wealthy on paper, yet exhausted, with children who grew up and you barely able to recall when and how.

Preserving - and ideally expanding - your freedom while building wealth is harder, but infinitely more valuable long-term.

Money without wellbeing

We’re constantly fed the idea that we have to join the global race to get rich.

Young people drop everything to chase their first million:

No time for relations

No time for the rest

No time for travels

No time for living how we want

They often reach the goal only to realize what they sacrificed can’t be bought back.

I want to be rich. But I want to be rich while building memories with people I love, traveling, and living fully—both as a young man and as a grandfather energetic enough to chase my grandkids.

It’s harder than just making money. I know. And I choose it anyway.

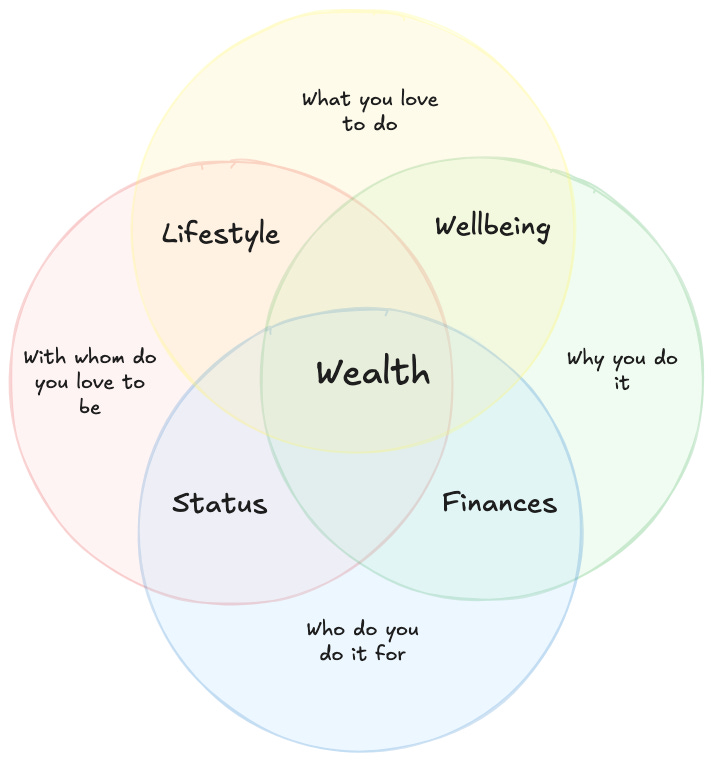

Money With Everything Else: My Definition of Wealth

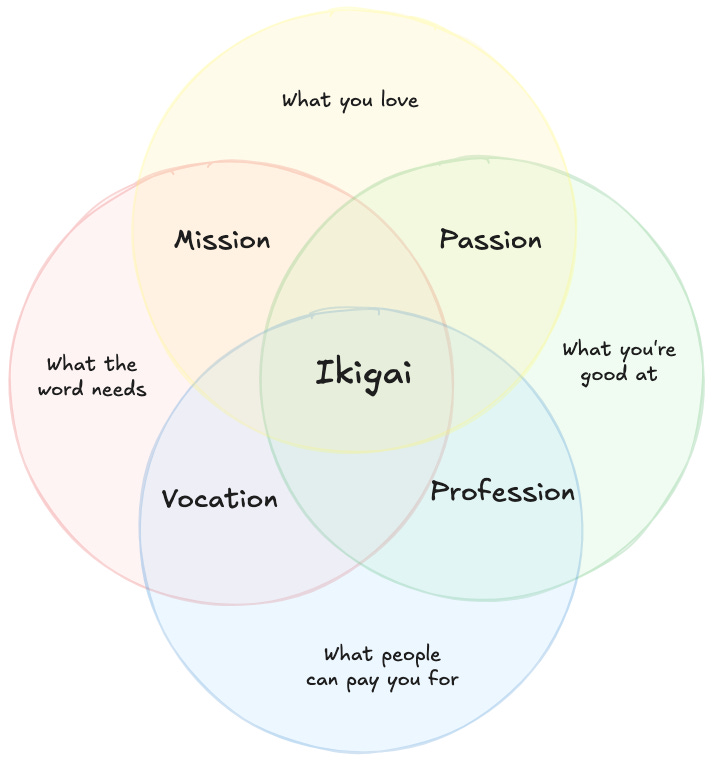

Japan has a concept called ikigai - a philosophy about finding a purpose worth devoting your life to.

In this approach, your ikigai is described by intersection of:

You are or can be good at

You love to do

Others need it - so you can feel important

People can pay you for doing - so you can cover your living.

This is way closer to what I aim for, when think about wealth, but not quite there yet.

Ikigai is beautiful, but it’s still activity-centric. True wealth, to me, is broader: it’s living your ikigai while maintaining the sustained balance of everything that matters.

You can have ikigai without wealth. You can be passionate, useful, and fulfilled - and still struggle financially.

So I think of wealth as balance across the core parts of my life:

Living the life I actually want

Having time for the people I love

Doing work that feels like ikigai - fulfilling and valuable

Possessing enough resources to sustain all of the above

It’s a harder definition. But it’s clear - and clarity removes friction and prevents unintentional sacrifices.

Setting up boundaries & definitions.

This perspective puts me in a small minority. Most people want to be rich, but I’d argue, a few can define exactly what that means.

I know what exactly I aim for.

I have setup multiple areas of my life that I want to keep in balance and constantly work on, focusing on whichever one slips.

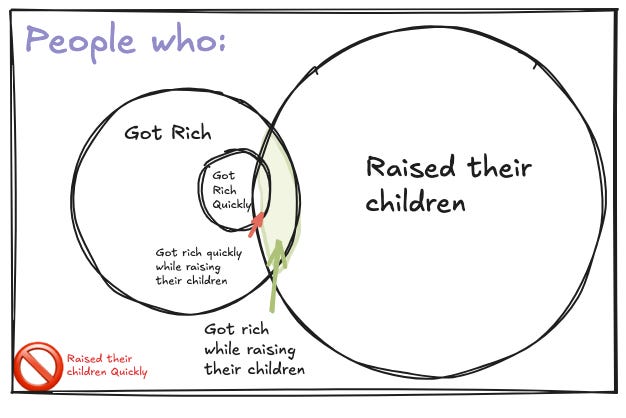

Example 1: Family first, money to follow

There are people that became milionaires (or bilionaires) within a few years. The odds of doing it though, are smaller the more we want to restrict the time.

However, there are no people who raised their kids quickly. None. Null. Zero. There is no shortcut.

Most people delay decision about family until they can afford it - risking to never have it.

I refuse to choose between being rich and having a family - so I aim for both. But I prioritize what can’t be postponed: relationships, marriage, parenting.

So I prioritized family early—got married and had kids while my peers were grinding for promotions. I trusted (correctly) that the financial piece could compound later; plenty of people have built wealth in their 30s, 40s, and beyond after starting families.

Ironically, becoming a husband and father made me better at everything else.

Parenting books and team-management books teach the same principles. Applying them made me a better engineer, a better leader, and a more grounded person.

My career took off. Finances followed - slower than if I’d focused on nothing else, but steadily and sustainably.

My career and income accelerated because I put family first, not in spite of it.

If you look for an advice, prioritize what can’t be rushed.

Example 2: Health in the Middle

Balancing all these areas is demanding. Early on, my health started slipping, so I dove deeper into how to maintain it—not repair it later.

My wife turned out to have a superpower here - deep expertise in nutrition, supplements, non-toxic living, and recovery protocols (amplified by maternal instinct).

She became an expert in areas I’d never willingly study.

With her beside me, not-loosing health became much easier than I’d ever anticipate if I’d choose to race for finances first.

Together we built systems that make staying healthy almost effortless. Health became a shared asset rather than another item on my to-do list, and I’ve realized, that chasing wealth together is easier and much more fun.

Priorities

Priorities become simple when your rules are clear. The world is unpredictable, and no plan is guaranteed - but you can stack the odds in your favor.

I want all aspects of wealth but when everything matters, you still have to sequence. My simple rule: prioritize what cannot be done (or done well) later.

Example:

Energy in your 80s is smaller than in your 50s → have kids early so you can enjoy grandkids.

Financial compounding works at any age → trust the process and focus on the irreversible first.

I trusted myself to figure out the financial side later. Plenty of people already did it and left roadmaps behind.

Summary

I now have strong foundations in health, family, freedom, and fulfillment. The financial pillar is the one that has lagged slightly - intentionally.

It’s time to pour more energy into Sustainable Business and scalable value creation while protecting everything I’ve built so far.

Join me as I build wealth the balanced way. No shortcuts. No burnout. Just progress. I’ll be sharing the journey as it unfolds.

Welcome aboard.